Case History: Restructuring Advisory & Valuation Support

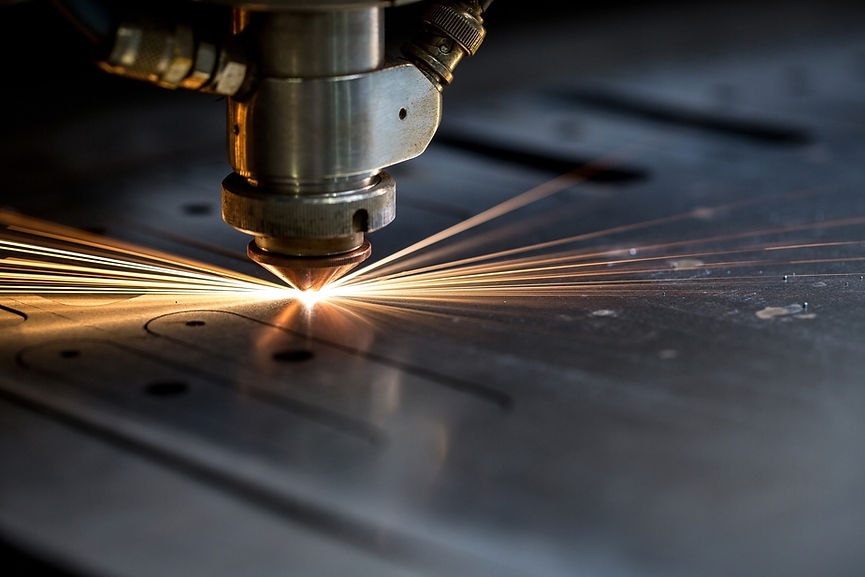

Custom Machine & Metal Fabrication:

Precision Manufacturing Client

North Georgia

Fortis was engaged by a distressed precision manufacturer to provide operational analysis, cash flow management, valuation support, and turnaround planning amid liquidity strain and high-cost MCA debt exposure.

Situation

A regional machine and fabrication business specializing in structural steel, ductwork, pipe fitting, and machining was facing escalating financial pressure. The company, referred to Fortis Business Advisors by an M&A attorney, was contending with declining profitability, strained liquidity, and a capital structure burdened by high-cost merchant cash advance (MCA) debt. The owners were injecting personal funds to keep operations afloat while exploring asset sales, including real estate, to raise capital. Although the company remained operational, the financial and organizational strain demanded immediate analysis and direction.

Objective

Fortis was retained to conduct a comprehensive financial and operational review. This included assessing assets and liabilities, developing a 13-week cash flow forecast, and evaluating both the near-term viability and longer-term restructuring options. Fortis also prepared an opinion of value using asset, income, and market approaches and designed a turnaround plan focused on job-level margin control, vendor management, and debt prioritization. Weekly cash flow updates and vendor payment tracking were maintained throughout the engagement to provide real-time visibility.

Results